This is because the correct amount. Government of Malaysia V MNMN.

Superfluous Tax Incentives Make It Real

Income earned by a person who resided in Thailand for a total of 180 days.

. Nevertheless taxpayers shall continue to be qualified for a tax deduction for income tax received outside India per Sec. Tax amnesty allows taxpayers to voluntarily disclose and pay tax owing in exchange for avoiding tax evasion penalties. This relief is applicable for Year Assessment 2013 and 2015 only.

Wages paid in Thailand or abroad. 40 of the Income-tax Act. For example you have until April 15 2024 to claim a 2020 Tax Refund April 15 2023 to claim 2019 Tax Refund and for 2018 until April 18 2022.

An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. All tax situations are different. The definition of assessable covers the following.

HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course. Housing and meal allowances or their value. It is a limited-time opportunity for a specified group of taxpayers to pay a defined amount in exchange for forgiveness of a tax liability including interest penalties and criminal prosecution relating to previous tax periods.

There were no changes announced in the income tax slabs both for old and new tax regimes for FY 2022-23 in Union Budget 2022. A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. 90 or income tax deduction under Sec.

Quick Guide To Tax Deductions For Donations And Gifts. OBTP B13696 2018 HRB Tax Group Inc. The monthly income tax is calculated as 112 of the annual income tax determined according to the progressive scale below.

The income tax slabs and rates have been kept unchanged since financial year FY 2020-21. Any amount paid outside India that is liable for tax exemption under Sec. Case Report Stay of Proceeding.

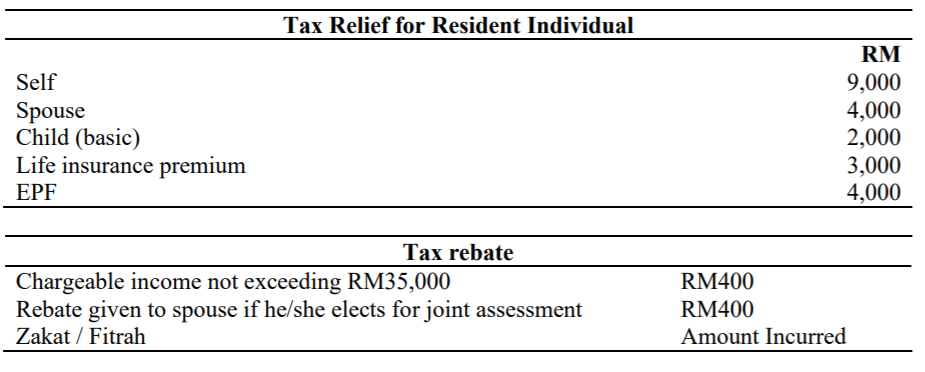

School fees for dependents paid for by employer. PAYE became a Final Withholding Tax on 1st January 2013. Everything You Should Claim As Income Tax Relief Malaysia 2022 YA 2021 Malaysia Personal Income Tax Guide 2022 YA 2021 Understanding Income Tax Reliefs Rebates Deductions And Exemptions In Malaysia.

This maximum investment amount is decided by the government. Income Tax on Earnings. For salaries income tax is to be withheld at source by the employer or the employee in the particular case of expatriates earning salaries from outside Tunisia for work done in Tunisia on a monthly basis.

Be aware that you can only claim your tax refund for a previous tax year within three years of the original tax returns due date or deadline. Final in the sense that once an employer deducts PAYE from the gross salarywage of a particular employee it represents the final tax liability on that income. Maximum Refund Guarantee Maximum Tax Savings Guarantee - or Your Money Back.

Based on the income tax slab an individual falls into they do their maximum tax saving. TurboTax Online Free Edition customers are entitled to payment of 30. However every section amongst these has a pre-set maximum investment amount.

Amendments To The Stamps Act 1949. It typically expires when some authority. Income tax in Thailand is based on assessable income.

The BEAT is imposed to the extent that 10 5 for 2018 of the taxpayers modified taxable income generally US taxable income determined without regard to any base-eroding tax benefit or the base-erosion percentage of the NOL deduction exceeds the taxpayers regular tax liability net of most tax credits. Schedule 5 of the Income Tax Act 1967. The most common sections in Income Tax Act are 80C 80CCD 1B 24 b and 80D.

If you get a larger refund or smaller tax due from another tax preparation method well refund the applicable TurboTax federal andor state purchase price paid. W-01A-275-042018 Case Report Tax Appeal before the Special Commissioners of Income Tax. Relief From Stamp Duty.

Get the facts from HR Block about the four types of IRS penalty relief and which IRS penalty relief option may be best for your situation. Paragraph 11 2c Schedule 2 of Real Property Gains Tax Act 1967. Section 194R was inserted in the Income Tax Act 1961 vide the Finance Act 2022 and was made applicable wef.

Income Tax - SECTION 194R TDS on benefit or perquisite in respect of business or profession Additional Guidelines for removal of difficulties under Section 194R2 of the Income-tax Act 1961 Introduction. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. For all other back taxes or previous tax years its too.

Malaysia follows a progressive tax rate from 0 to 28. For FY 2021-22 and 2022-23 individual taxpayers will continue to choose between two tax regimes - the existing or old tax regime and. 91 is regarded to never have been allowable per Sec.

As a result most employees will not be required to lodge Form S returns.

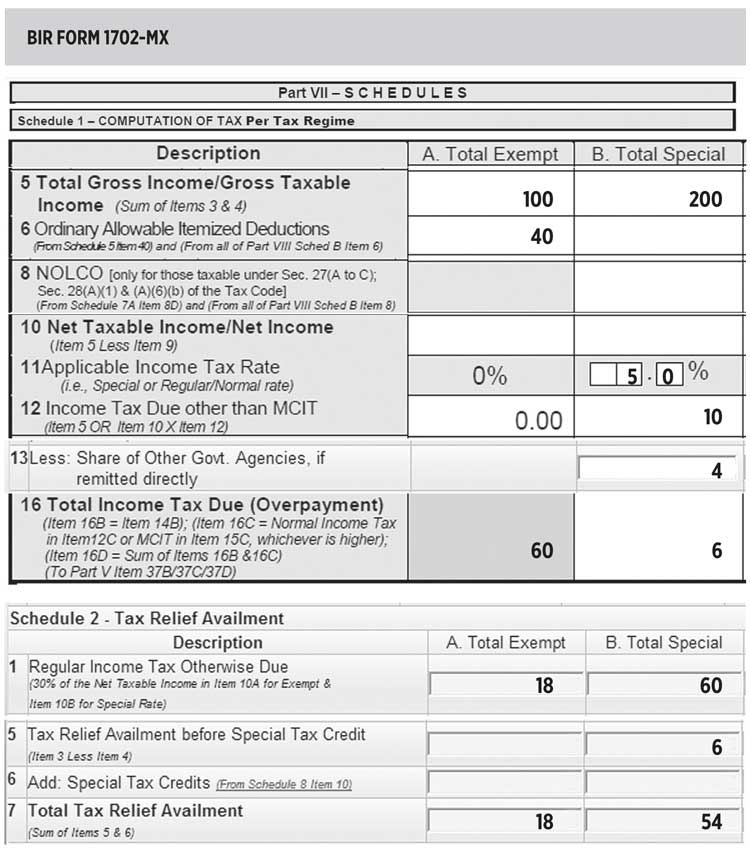

Tax Relief For Year Of Assessment 2018 Plctaxconsultants

Updated Guide On Donations And Gifts Tax Deductions

How To Handle Venture Capital Tax Reliefs

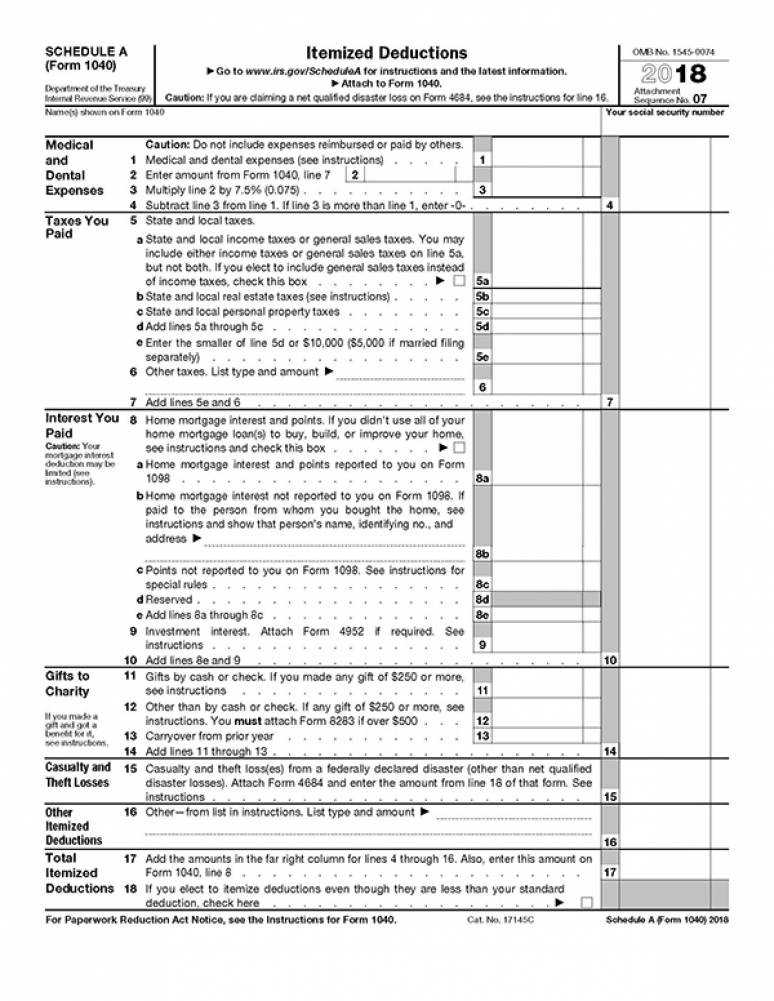

2018 Irs Tax Forms 1040 Schedule A Itemized Deductions U S Government Bookstore

Reliefs For Personal Income Tax 2017 Vs 2016 Teh Partners

Cheng Co New Update Caution Common Mistake Tax Payer Will Claim For Sport Equipment For Tax Relief Swimming Suit Is Prohibits To Claim Tax Relief Sport

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About

Top 4 Methods To Enjoy Tax Relief For Education Purpose Kclau Com

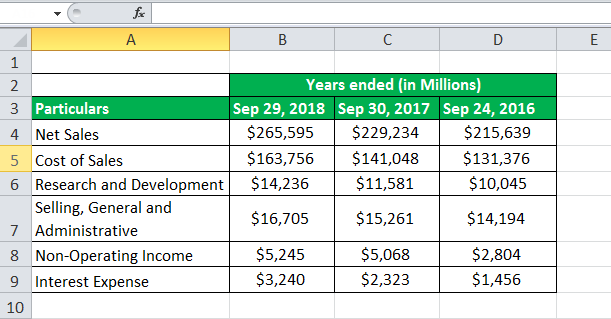

Taxable Income Formula Examples How To Calculate Taxable Income

Penjana Tax Relief And Stimulus For Malaysia Budget 2021 Financio

Income Tax Malaysia 2018 Mypf My

Personal Income Tax For Ya2019 What Life Insurance Category Changed Finance Malaysia Blogspot

The Following Allowances And Tax Rates Are To Be Used Chegg Com

North Carolina Providing Broad Based Tax Relief Grant Thornton

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

21 Tax Reliefs Malaysians Can Get Their Money Back For This 2019 World Of Buzz

Individual Tax Relief For Ya 2018 Kk Ho Co

Reliefs For Personal Income Tax 2017 Vs 2016 Teh Partners